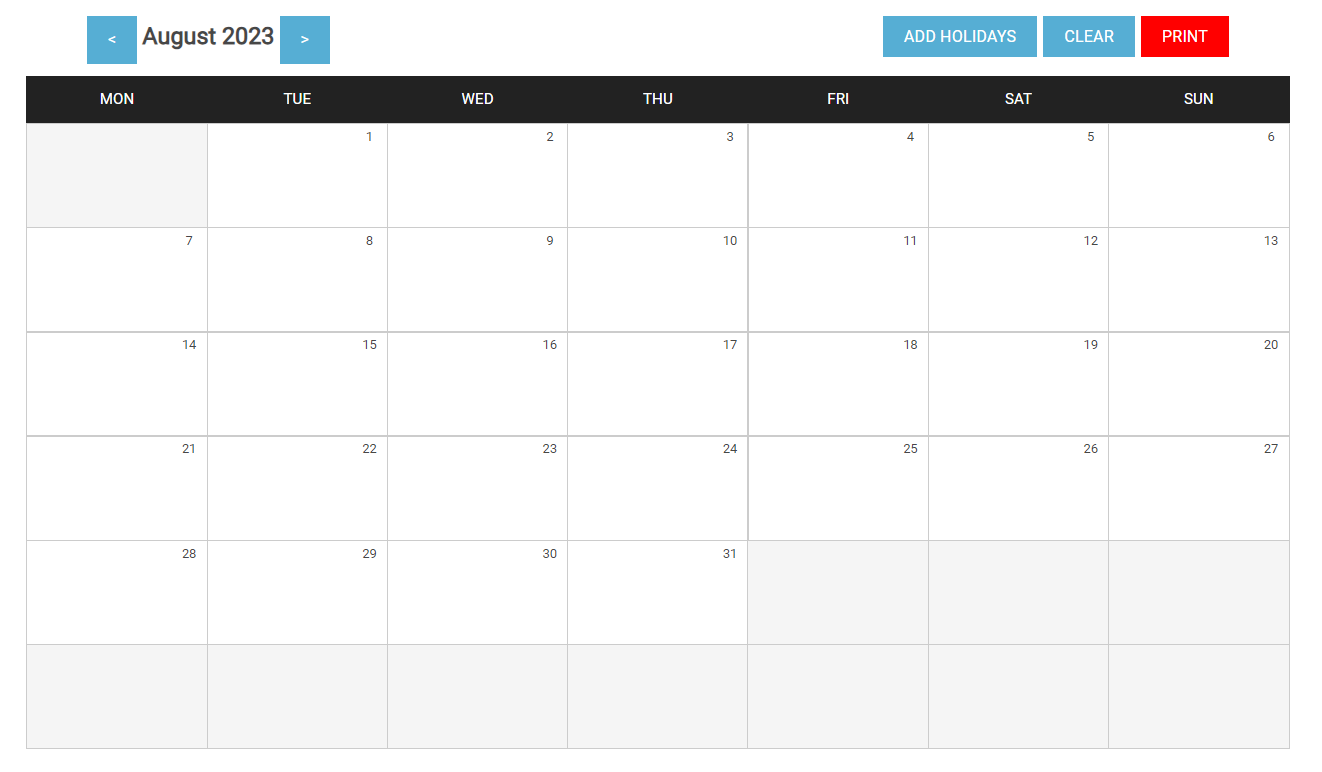

- TDS payment for the month of July – 2023 – 7th August 2023.

- GSTR -1 for the month of July 2023 – 11th August 2023.**

- EPF – Payment and Electronic Challan & Return (ECR) for the month of July – 2023 – 15th August 2023.

- ESIC payment and ECR – for the month of July – 2023 – 15th August 2023.

- PT payment and monthly return – July – 2023 – 20th August 2023.

- GST Payment and GSTR – 3B for the month of July – 2023 – 20th August 2023.**

- Quarterly TDS certificate – Form – 16A (With respect to tax deducted for payments other than salary) for the quarter ending June 30, 2023 – 15th August 2023.

Note: Due to extension of due date of TDS statement vide Circular no. 9/2023, dated 28-06-2023, the revised due date for furnishing TDS certificate shall be October 15, 2023

* Updated as of 1st August 2023.

** Please keep in touch with your tax consultant / adviser for any further clarification.

*** This document is issued in the general interest of knowledge transfer purpose only and it cannot be construed in any other manner whatsoever.