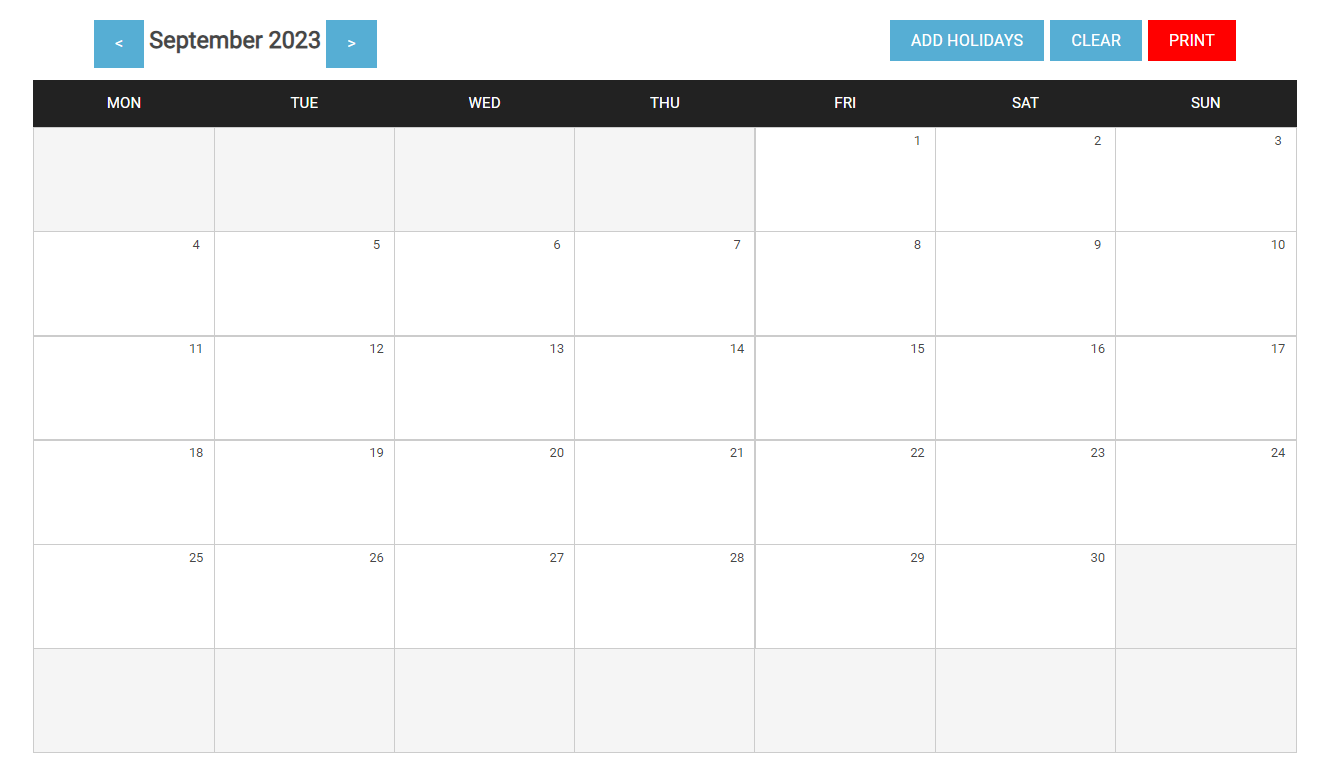

- TDS payment for the month of August – 2023 – 7th September 2023.

- GSTR -1 for the month of August 2023 – 11th September 2023.**

- EPF – Payment and Electronic Challan & Return (ECR) for the month of August – 2023 – 15th September 2023.

- ESIC payment and ECR – for the month of August – 2023 – 15th September 2023.

- 2nd Installment of Advance Tax Payment for the FY – 2023 – 24 – 15th September 2023.

- PT payment and monthly return – August – 2023 – 20th September 2023.

- GST Payment and GSTR – 3B for the month of August – 2023 – 20th September 2023.**

- Due date for filing of audit report under section 44AB for the assessment year 2023-24 in the case of a corporate-assessee or non-corporate assessee (who is required to submit his/its return of income on October 31, 2023) – 30th September 2023.

- Quarterly statement of TDS (eTDS) deposited for the quarter ending June 30, 2023. Special Note: The due date of furnishing TDS statement has been extended from June 30, 2023 to September 30, 2023 vide Circular no. 9/2023, dated 28-06-2023.

- Quarterly statement of TCS (eTDS) deposited for the quarter ending June 30, 2023. Special Note: The due date of furnishing TCS statement has been extended from June 30, 2023 to September 30, 2023 vide Circular no. 9/2023, dated 28-06-2023.

- Last date of convening the Annual General Meeting for the financial year ended 31st March 2023 – 30th September 2023.

- DIN KYC / DIR – 3 –30th September 2023.

* Updated as of 1st September 2023.

** Please keep in touch with your tax consultant / adviser for any further clarification.

*** This document is issued in the general interest of knowledge transfer purpose only and it cannot be construed in any other manner whatsoever.